Bitcoin price briefly slid to a new monthly low before trimming some of the losses and settling into sideways action through the Asian trading session.

Risk appetite remained weak as traders digested a wave of bearish headlines.

The total crypto market cap also wobbled, momentarily dipping below the $3 trillion threshold before bouncing back above that key psychological level as selling pressure eased.

Sentiment took a hit across trading circles, with the crypto fear and greed index slipping 5 points to 29, edging deeper into Fear territory.

Altcoins fared poorly overall, though a handful of outliers managed to post modest gains, pushing a few tokens into the green.

Why is Bitcoin price down today?

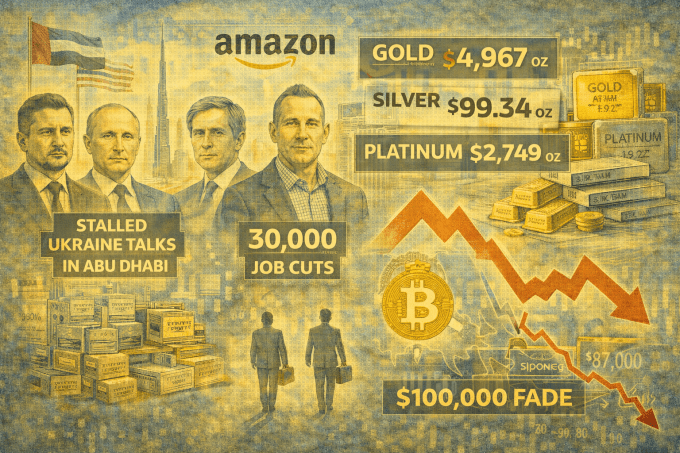

Bitcoin price fell to an intraday low of $86,126 on Monday as traders reacted to renewed geopolitical tensions and political gridlock in Washington.

The sharp decline followed former President Donald Trump’s threat to impose 100% tariffs on Canadian imports, citing concerns over Canada’s alleged involvement in a trade agreement with China.

Since the announcement, over $100 million has exited the crypto market.

While Canadian officials quickly clarified they had no intention of finalising a deal with China, the initial shock appeared to unsettle broader markets.

The uncertainty has contributed to heightened volatility and a cautious tone across risk assets, particularly in crypto.

At the same time, growing anxiety over a possible US government shutdown has further weighed on sentiment.

The funding bill needed to keep federal agencies operational has yet to be approved.

Although the House passed the measure last week, it now faces resistance in the Senate, where Democrats have reportedly blocked progress amid public unrest following a fatal police shooting in Minneapolis.

The legislative impasse not only raises concerns about federal operations but could also delay progress on key crypto-focused policies.

One of the affected items is the CLARITY Act, which remains stalled on the Senate agenda and risks further delays if a shutdown occurs.

According to data from CoinGlass, Monday’s slide had wiped out $605 million in long positions across the crypto derivatives market by early trading hours.

Of that total, $179.8 million came from Bitcoin futures and another $203.6 million from Ether-based contracts.

Some traders appear to have rotated capital into safer alternatives. Gold, in particular, has gained strong momentum since the October crash and continues to outperform digital assets.

The bellweather safe haven asset has recently crossed the $5,000 mark, rising more than 17% so far this year, while Bitcoin remains down over 30% from its all-time high of $126,080.

While markets remain defensive, focus now shifts to upcoming US economic events that could influence the short-term outlook.

The Federal Reserve is scheduled to hold its first policy meeting of 2026 on Wednesday. At its previous meeting in December, the central bank cut rates by 25 basis points, bringing the target range to 3.5%–3.75%.

However, most analysts expect the Fed to keep rates steady this month, given the recent easing cycle. Still, any shift in tone or forward guidance could sway market expectations.

Another key event on the radar is the release of December’s Producer Price Index (PPI) inflation data.

Crypto markets tend to react to inflation metrics, and the November PPI reading, coming in well above 3%, coincided with a period of price stagnation across major tokens. A similar outcome could reinforce bearish pressure heading into February.

Will Bitcoin price go up or crash?

$90,000 has once again become the key level that bulls must reclaim to calm the nerves of investors that remain risk-averse.

Like we have seen over the past few trading sessions, every time the Bitcoin has breached through $90,000, its price has posted modest rallies.

The situation is not different this time unless investors find fresh bullish cues elsewhere.

Subsequently, $95,000 would come into play, which, for the time being, remains a critical upside target that could help restore market-wide confidence if reclaimed convincingly.

One catalyst that may help support this recovery is the return of institutional demand in the form of inflows generated by spot Bitcoin ETFs.

According to data from SoSoValue, these funds have posted consistent outflows between Jan. 16 to Jan. 23.

If inflows pick up as the Monday trading session begins, it could help erode some of the downside pressure and pave a path towards $90,000.

On X, market analyst Friedrich was betting on Bitcoin filling two CME gapns, one around $89,500, while the other was located notably higher above $95,000.

“Sooner or later, we’ll get them filled,” the analyst wrote.

Bitcoin/USDT 4-hour price chart. Source: Friedrich on X.

CME gaps like these tend to act as price magnets that and historically Bitcoin has moved to fill these gaps most of the time. Filling these gaps would mean reclaiming above key support levels.

A similar idea was also floated by well-followed analyst Ted Pillows earlier in the day. See below.

$BTC now has 2 CME gaps to the upside.

The first one is at $89,350 and the other one is at $93,000.

Since October 2025, 100% of Bitcoin CME gaps have been filled within 2 weeks, so keep an eye.

Coming in with a bearish take was fellow market watcher Tazman, who pointed to a descending channel that Bitcoin had been tracking on the daily time frame.

Based on his analysis, the next likely target for Bitcoin remains around $85,000.

looking at the $BTC chart, the structure is pretty clear right now.

we are in a descending channel and price is respecting it cleanly. lower highs, controlled sell pressure, no real impulsive reclaim yet. as long as this channel holds, downside probing makes sense.

the next

At press time, Bitcoin was trading at $87,419, placing it well within the upper bounds of the bearish pattern.

Top altcoin gainers for the day

The altcoin market cap rose 2.3% to an intraday high of $1.31 trillion before stabilising around $1.30 trillion at press time.

Ethereum (ETH), remained volatile throughout the day but managed to recoup all of its losses and settle around $2,940 at the time of publication.

Other large-cap cryptocurrencies showed a mixed scenario, with XRP (XRP), Dogecoin (DOGE), and Cardano (ADA) gaining around 1-3% later in the day, while Solana (SOL) and Tron (TRX) had posted minute losses by late Asian trading hours.

At press time, most of the top 100 altcoins were moving back into the green territory as Bitcoin bulls were defending $87,500 with conviction.

A standout performer in an otherwise volatile session, River (RIVER) notched a 30% gain following news of a significant funding round.

With participation from prominent figures like Justin Sun and Arthur Hayes, the project is now well-positioned to bridge its stablecoin infrastructure into the Tron network using this fresh funding.

The altcoin also benefited from a short squeeze as bearish bets backfired.

For Axie Infinity (AXS), which followed with gains of nearly 14% today, the main catalyst was an economic reform that reduced inflationary supply and curbed bot farming, while also introducing a new reward system to incentivise long-term holding among investors.

High speculative interest and a short squeeze further supported the token’s gains.

Algorand (ALGO) locked in smaller gains of 7%, mainly due to the immediate liquidity boost from its recent Kraken exchange USDC integration.

By enabling direct stablecoin deposits and withdrawals, the move has improved capital flow efficiency for the ecosystem, providing a timely catalyst that helped the token recover from weekend losses.

Source: CoinMarketCap

The post Bitcoin dips below $87K on US-Canada trade war fears; RIVER jumps 30% appeared first on Invezz